Fitch Warns of Trump Risk for Latin America

Trump tariffs, immigration policy could hit economies, trade, remittances.

BY LATINVEX STAFF

Fitch Ratings warns in two reports that a potential Trump Administration will negatively impact Latin America.

“Scenario analysis by Fitch’s economics team shows that aggressive unilateral tariff hikes by the U.S. would lead to a 0.2% to 1.9% reduction of Mexico’s GDP relative to our baseline expectations,” the ratings agency says.

Among Donald Trump’s more high-profile policy proposals has been his support for a 10% tariff for all imports, Fitch points out.

“Coupled with recent judicial reform, this exposure could increase business uncertainties and dampen long-term growth if blanket tariffs are imposed and the business environment structurally deteriorates,” it says.

The U.S. is Mexico’s largest trading partner, with exports representing more than 30% of Mexico’s GDP. Trade protectionism, industrial strategy and rebuilding the U.S.’s manufacturing base could result in increased risks from tariffs or other protectionist measures negatively affecting Mexican corporates, Fitch warns.

Autos and auto parts are Mexico’s largest exports to the U.S., on which Trump has suggested significant tariffs. Among Fitch-rated Mexican corporates, auto suppliers like Nemak (BBB-/Negative) and Metalsa (BBB-/Stable) have the most direct exposure.

Increased trade friction with the U.S. could also have a broader negative impact on Mexico’s economy and dampen consumer spending. This could affect the retail, real estate & homebuilding, and food, beverage & tobacco sectors, which together account for around 40% of total revenues within Fitch’s rated universe of Mexican corporates.

IMMIGRATION & REMITTANCES

Meanwhile, immigration tightening and a more confrontational posture from the U.S. towards Mexico and Central American countries could emerge should Trump be re-elected.

“While implementation remains uncertain, his administration has increasingly indicated a willingness to significantly restrict border crossings and materially increase deportations of undocumented migrants,” Fitch says.

On the other hand, Fitch Ratings expects policy continuity from the Biden administration if Kamala Harris is elected. A potential Harris administration has voiced the intention to push for a bipartisan law that failed to pass in 2024 after Republican objection. The bill aims to close loopholes in the asylum process, give the president greater authority to shut the border when crossings are high, and limit immigration parole, which allows migrants to temporarily enter the U.S.

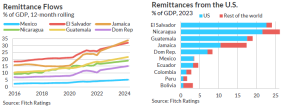

One of the largest recipients of remittances globally is Mexico, where inflows have steadily increased over the past decade to close to 3.5% of GDP, from 2%. And

Central America is highly vulnerable to US immigration policies, as remittances fund a large component of their economic activity. Remittances for El Salvador and Nicaragua now account for more than 30% of GDP.

“Remittances mainly boost consumption growth, at times serving as an economic countercyclical mechanism during downturns in the receiving economies,” Fitch points out. “These flows often fund large trade imbalances in consumption-based Central American economies. More than 90% of remittances are used to cover daily consumption expenditures.”

© Copyright Latinvex

RELATED ARTICLES

Trump Tariff Would Violate USMCA, LatAm FTAs

Latin America Most Exposed to Trump Risk

Moody’s Analytics: Trump Tariffs Would Cut Mexico Growth

Trump & Latin America: What to Expect