What Latin American Female Consumers Buy Most

From household and personal care goods to video games and cars.

BY VALENTINA DUQUE

Marketing experts in Latin America know that women are the leading consumers. They also know that it’s usually women who have the biggest influence on the purchasing decisions of most products.

And they are right.

Market research shows that, worldwide, women account for between 70% and 85% of purchasing decisions. It is estimated that women make the decision in 94% of home furniture purchases, 92% of vacations, 91% of housing expenses, and 60% of car purchases.

Plenty more could be said about makeup, personal care, beauty, or lifestyle goods—segments that tend to focus on a female audience. According to NielsenIQ, women spend 70% more than men on health and beauty products, while accounting for close to 57% of buyers in online sales.

But let’s focus on the landscape in Latin America. In this article we look at what products women buy the most—or those on which they have the most influence—in Latin America.

#1 Household Products and Consumer Goods

In Latin American culture, woman still have by far the greatest burden of domestic work and unpaid care within the home. ECLAC reports that, on average, women spend 35.1% of their time on these tasks, while men spend just 14.7%. For this reason, we might expect women to be the main contributors and stewards of household and housing expenses.

In Mexico, 86% of growth in spending on dairy comes from women. Even outside the home, “categories offering wellness and indulgence, such as fermented dairy, ice creams, and ice pops, as well as flavored milk, have more buyers among women than men.

In Colombia, it is estimated that women spend 49 out of 100 pesos on food, while men spend just 24 pesos. Also, in 2022, women in Colombia bought and paid for 56.4% of spending in the home.

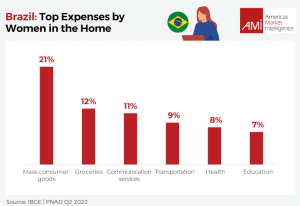

In Brazil, the data are even more surprising: according to Nielsen, 96% of purchases in households are decided by women, and they dedicate more than 20% of their personal income to domestic spending. Another study, this time by the Brazilian Institute of Geography and Statistics (IBGE by its acronym in Portuguese), mentions the following spending by women in the household (see graph):

Lastly, in Chile, 79% of women say the products they buy or shop for the most are from supermarkets (Ministry of Economy, Development, and Tourism, 2023).

#2 Beauty and Personal Care

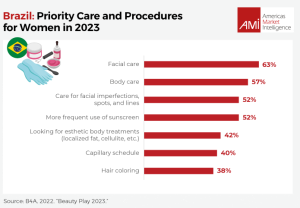

The beauty and personal care category is where we find the products most purchased by women in Latin America. This segment has experienced significant growth since the pandemic. In Mexico, for example, there has been a 22.5% cumulative increase in sales of fragrances and skin products over the last three years, according to Kantar. And in Chile, Euromonitor International reports show “dramatic growth” in facial care purchases since 2021.

New trends have emerged around this—many of them promoted by social networks. For example, care for curly hair or skin care routines. Kantar estimates that nearly a million households in Mexico are adding capillary treatments to their hair care routines. And in Brazil, a report by consulting firm B4A revealed that, in 2022, 63% of women surveyed considered “facial care” would be their priority next year.

#3 Fashion: Clothing

Clothing, shoes, and other fashion products have traditionally been categories of desirable products for women.

The segment is continuing to grow: in Mexico, households that buy women’s clothing went from 55.3% in 2019 to 65.3% in 2023. In Brazil, it is estimated that 66.7% of online shoppers of fashion products are women. With regard to Brazil it should be noted that, according to a study by BRAIN Inteligência Estratégica (2023), at least 64% of Brazilian online consumers buy clothes in Asian marketplaces such as Shopee, Shein, or AliExpress at least once a month. The buyer’s profile is usually a single 29-year-old woman with an income of between R $2,500 and R $4,500 (roughly US $500–900).

#4 Fashion: Footwear

Consulting firm EMR reports that the footwear market in Latin America was worth approximately $15.2 billion in 2023, and could reach US $19.7 billion in the next 10 years. The firm says a key factor driving footwear consumption in Latin America is the “positive increase in the number of working class women who demand different shoe designs made with comfortable materials for everyday, esthetic use, due higher earnings and disposable income.”

As with clothing, most footwear shopping is happening online—a trend known as E-fashion. Kantar reports that online footwear consumption in Mexico rose from 4.8% to 6% between 2021 and 2022.

#5 Video Games (Especially Mobile Games)

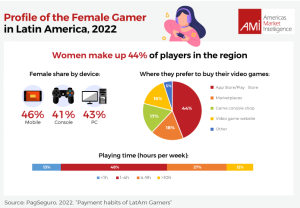

It may be surprising to see video games among the products most popular with women in Latin America, as it is a trend that is just beginning to consolidate. In 2022, the share of women playing video games was 44%, according to PagSeguro. As for mobile gamers, 46% are female. The popularity of mobile gaming in the female segment lies in the fact that women’s first contact with gaming is usually through the smartphone, eventually migrating to the console.

Women’s taste for video games is much more pronounced in certain Latin American countries:

Brazil: according to the “Game Brasil” report, in 2024 the share of women as mobile gaming consumers reached 61%.

Argentina: an estimated 50.6% of those gaming on their cell phone are women, the majority being millennials aged between 25 and 34 (26.7%).

Colombia: 52% of women have had contact with video games at some point in their lives. Of them, 36% consider themselves regular players (playing at least three times a week).

#6 Cars

The car is a coveted product among Latin American women. In Brazil, a survey by Webmotors (2024) found that 71% of women have the intention to replace their vehicle. Of them, 64% would like a car and only 7% would prefer a motorcycle. Favorite vehicles for women include sedans (54%), SUVs (47%), and hatchbacks (24%).

In Argentina, the Association of Automotive Dealers of Argentina (ACARA by its initials in Spanish) estimates that women influence 80% of vehicle purchases. And in Chile, data from MG Motor show that 42% of new car purchases are made by women. Unlike Brazil, in Chile 74% of women prefer SUV models, 23% hatchbacks, and only 3% sedans.

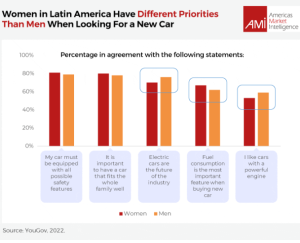

As far as priorities go when buying a vehicle, a study from YouGov (2022) found fundamental differences between men and women in Latin America. Women tend to be rational shoppers who value, much more than men, attributes related to safety and convenience (see graph).

Valentina Duque is a Marketing Associate at Americas Market Intelligence.

This article was first published by AMI. Republished with permission.