Moody’s Analytics: Trump Tariffs Would Cut Mexico Growth

Trump tariffs would shave off nearly 0.7% of Mexican GDP growth.

BY LATINVEX STAFF

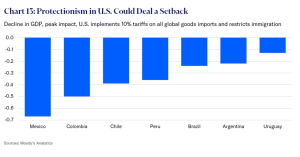

Moody’s Analytics predicts that if Donald Trump is elected to president and implements a 10% tariff on all imports, as he has pledged, the measure would shave off almost 0.7% from Mexico’s economic growth.

Other Latin American countries such as Colombia, Chile and Peru would also be hard hit, predicts Moody’s Analytics, which is a division within Moody’s that is separate from Moody’s Ratings.

“The upcoming U.S. election is [a] source of uncertainty,” it says. “Should a new administration impose sharp tariffs and more restrictive immigration policies, the consequences for Latin America could be significant.”

Preliminary work with its global macroeconomic model, which links more than 70 countries through trade, financial markets, capital flows, labor markets and sentiment, suggests that a more protectionist tack could result in economic stress across the region.

“The impacts would be most concentrated in Mexico, where reduced U.S. imports, a reduction in Mexican migration to the U.S., and reduced remittances would put the Mexican economy in a bind,” Moody’s Analytics says. “The Colombian economy would also struggle given its reliance on crude oil exports to the U.S.”

Colombia would likely see a decline of 0.5% from its economic growth, Chile less than 0.4% and Peru between 0.3% and 0.4%.

Even without a Trump tariff, Mexico faces a slowdown, Moody’s Analytics warns.

“Though Mexico’s exports to the U.S. and remittance receipts are still chasing records, we expect these two key supports to turn as the U.S. labor market gradually slows,” it says. “Also pumping the breaks will be reduced government spending as the incoming administration eyes a lower fiscal deficit.”

However, Moody’s Analytics does expect momentum to continue on Mexico’s investment front.

“While not sufficient to avert a broader slowdown, foreign direct investment in Mexico’s manufacturing sector is running at a 10-year high as global manufacturers continue to seek an alternative to China,” it says. “As late as 2010, factory wages in China were still lower than in Mexico, but this cost advantage has eroded amid slower growth in China’s labor force. Today, monthly manufacturing compensation in Mexico is about 40% lower than in China and compares more favorably with manufacturing bases in Southeast Asia.”

© Copyright Latinvex

RELATED ARTICLES

Trump & Latin America: What to Expect

Trump Tariff Would Violate USMCA, LatAm FTAs