Mexico Nearshoring: The China, IRA Impacts

How the US-China trade war and the Iinflation Reduction Act could shape Mexico’s nearshoring future.

BY ADRIAN DUHALT

Due to a confluence of factors, Mexico recently emerged as the United States’ largest trading partner (Figure 1). Key among these is the ongoing trade war between the United States and China, which intensified during the Trump administration and is estimated to have affected bilateral trade flows valued at roughly $450 billion. Another factor is the rise of “nearshoring,” or the relocation of manufacturing to North America. This trend coincided with the COVID-19 pandemic, which exposed vulnerabilities within U.S. supply chains and prompted the U.S. government to pursue an industrial policy designed to mitigate risks. Taken together, these developments triggered a geographical reconfiguration of global supply chains expected to continue well into the future.

Given its proximity to and trade agreement with the U.S. — coupled with its long-standing industrial infrastructure intertwined with that of its northern neighbor — Mexico is well-positioned to capture a significant share of the expected investment related to nearshoring, provided that suitable policies and incentives are in place. To assess Mexico’s potential for nearshoring, several variables need careful consideration. Among these is U.S. legislation designed to strengthen supply chains in strategic industries.

This brief contends that the Inflation Reduction Act (IRA), enacted by the Biden administration to expedite the energy transition and build more resilient and globalized supply chains, could eventually help Mexico attract greater investments related to nearshoring. Notably, the manufacturing of electric vehicles (EVs) and batteries serve as important test cases. If events unfold as anticipated, laws such as the IRA could help solidify Mexico’s position as the United States’ foremost trading partner for years to come.

Prospects for US-Mexico Trade and FDI Flows

The steep tariffs that the U.S. government levied on goods imported from China in 2018 have effectively reduced the value of trade between the two countries. Between 2018 and 2019, the value of U.S. imports from China declined from $539 billion to $449 billion, a reduction of around 16.7% (Figure 1). This decline significantly benefitted Mexico, which surpassed Canada to become the United States’ leading trade partner in 2019. Although China regained its top position in 2020, the ongoing trade dispute with the U.S. suggests that it will likely continue losing market share of overall U.S. imports. This is creating a more dynamic trade relationship between the U.S., Canada, and Mexico, resulting in Mexico reclaiming the top trading spot in 2023 (Figure 1).

Examining the aggregate trade values between the United States and its principal trading partners also reveals Mexico’s growing prominence. Based on data for 2018 and 2023, U.S. trade with Mexico experienced the most substantial growth. Trade expanded from $610 billion to $799 billion over that period, equivalent to an increase of 31%. This growth rate surpasses that of Canada, whose trade with the U.S. saw an increase of roughly 25.2%, climbing from $618 billion to $774 billion in the same period.

China’s trade position is more complicated. Driven by a 20.7% decrease in U.S. imports, overall trade between the two nations experienced a slowdown, falling from $659 billion in 2018 to $575 billion in 2023, a contraction of 12.7%. The comparative trade advantage that China gained following its accession to the World Trade Organization in 2001 has eroded amid rising tensions with the United States. This has potentially paved the way for Mexico to emerge as the leading supplier of goods to the U.S. market in 2023 — for the first time in two decades.

Recognizing that raw numbers may provide limited insight into the underlying dynamics of supply chain reshuffling, a more comprehensive analysis is required to assess the extent to which Mexico has attracted investment being “de-risked” out of China. Central to this inquiry is whether Mexico’s economy can maintain or even expand its current position and dynamism in the years to come.

The answer to this hinges on numerous factors, including the outcome of the country’s presidential election in June 2024 and other important domestic challenges. However, amid the current global circumstances triggering the relocation of manufacturing activities, Mexico’s long-term prospects for attracting investments aimed at export markets, particularly the U.S., appear promising.

Two reports published in 2023 offer optimistic forecasts. The first suggests that by 2027, Mexico’s exports could reach up to $609 billion, an increase from $455 billion in 2022. The second report projects that between 2024 and 2028, nearshoring could yield “additional profits close to $168 billion in non-oil exports, which implies an annual average of $33.6 billion.”

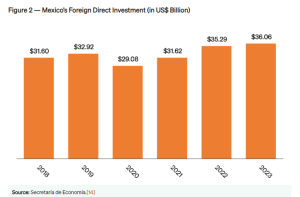

For this export potential to materialize, however, Mexico will require significantly higher levels of foreign direct investment (FDI). The 2023 figures released by the Secretaría de Economía (“Secretariat of Economy”) fail to provide conclusive evidence regarding the FDI flows associated with nearshoring (Figure 2). Mexico’s FDI reached $36.06 billion in 2023, its highest level since the start of the current government. However, these flows offer only a modest glimpse into the country’s potential, as just 13.3% (or $4.82 billion) corresponds to new investments. This suggests that the relocation of manufacturing activities to Mexico has yet to materialize to the extent that many anticipated or desired.

On a more positive note, the reinvestment of profits appears to be helping the expansion of exports, constituting 73.9% (or $26.63 billion) of FDI flows, up from just 45.4% a year earlier.

More likely than not, the upward trajectory of FDI flows into Mexico will continue, despite domestic challenges in areas such as security, rule of law, and clean energy.

As the U.S. intensifies its efforts to reduce China’s influence over key supply chains, trade frictions between the two nations will likely continue. The EV industry, which includes the sourcing and processing of critical minerals as well as the manufacturing of batteries, is anticipated to increase antagonism between the world’s two largest economies — with Mexico potentially stuck in the middle.

Due to its geographic proximity, deep trading connections, manufacturing capabilities, and competitive labor force, Mexico stands as a prime candidate for manufacturers looking to enter or expand their presence in the U.S. market. As the world’s 7th largest car manufacturer and the 5th largest exporter in 2021, Mexico holds a strong position to attract such investment. China’s EV brands such as BYD could soon be a case in point.

Potential Impact of the Inflation Reduction Act on Nearshoring

Concerned about supply chain vulnerabilities, on Feb. 24, 2021, the Biden administration issued an executive order mandating the creation of a report to evaluate the state of U.S. supply chains. Published in June 2021, this report, which includes contributions from the departments of Energy, Commerce, Defense, and Health, focused on four industries: 1) manufacturing of semiconductors and advanced packaging; 2) high-capacity batteries; 3) materials and critical minerals; and 4) pharmaceuticals and advanced pharmaceutical ingredients.

A significant finding of the report is that key supply chains, such as those for critical minerals and large-capacity batteries, are controlled by a limited number of countries, which creates serious vulnerabilities for U.S. companies in the event of supply chain disruptions. Particularly troubling is the dominance of China in these areas. Despite having a relatively limited role in relation to mineral reserves and production, China exerts considerable control over the supply side of these chains and possesses advanced domestic mineral processing capabilities.

For instance, in the manufacturing of materials for batteries and cells, China’s global participation is around 75%, while that of the United States is less than 10%. Regarding critical minerals, the 2021 report specifies that China controls a respective 60% and 80% of the refining capacity for lithium and cobalt, both of which are essential for manufacturing high-capacity batteries used in electric cars and storage.

Moreover, China’s grip on critical minerals supply and processing, in addition to battery manufacturing, poses significant risks to U.S. decarbonization goals and, more precisely, to the growth prospects of the U.S. EV industry.

In light of these findings and recognizing the need to develop resilient supply chains that are less dependent on China and capable of accelerating technological developments in the energy transition, the Biden administration enacted the IRA on Aug. 16, 2022. This law allocates incentives of approximately $369 billion to address climate change and bolster energy security. The IRA is anticipated to significantly boost the electric car market, along with other clean technologies and energy sources. By 2030, the goal is for 50% of automobile sales in the United States to be electric. If achieved, this would entail an increase in demand for both batteries and critical minerals.

To boost domestic demand, the IRA provides a number of incentives for consumers to purchase EVs, including a $3,750 rebate when a certain percentage of the value of the critical minerals contained in the battery have been mined or processed in the U.S. or a country with which the U.S. has a free trade agreement. Additionally, another $3,750 rebate is provided if a certain percentage of the value of the battery components has been manufactured in North America, including Mexico. These thresholds start at 40% in 2023 and gradually increase to 80% by 2027 for critical minerals, and from 50% in 2023 to 100% by 2029 for battery components.

In addition to the IRA, the Biden administration enacted the Bipartisan Infrastructure Act on Nov. 15, 2021. This legislation proposes a $7.5 billion investment to establish a network of 500,000 chargers for electric cars across the United States.

Taken together, these incentives are projected to transform the landscape of the EV industry in the United States in this decade and beyond. Mexico, in particular, stands to play a significant role as a supplier and beneficiary of robust investment in this sector. As noted earlier, Mexico possesses important advantages that may help it to capture part of the manufacturing market for batteries, electric cars, and their components, which are expected to be in high demand in the United States as a result of the IRA provisions. This environment could prompt existing car and auto parts manufacturers in Mexico to contemplate expanding into EV production, therefore boosting exports to the U.S. However, new players — especially from China — are entering the fray as they assess available opportunities in the North American EV industry.

Expansion of China’s Automotive Brands in Mexico

China’s ambitions to elevate its EV brands to global prominence while maintaining its grip over supply chains will inevitably collide with U.S. efforts at strengthening its own EV and clean energy industries. These tensions, along with potential opportunities in the EV supply chain serving the U.S., could help Mexico attract higher FDI inflows and increase the value of exports to its northern neighbor.

The automotive industry has long been a driving force for trade between Mexico and the United States, and this influence is expected to remain strong in the foreseeable future. However, in light of the U.S.-China trade war and Mexico’s nearshoring prospects, a crucial development must be considered: the growing presence of China’s car brands in Mexico and their alleged plans to establish EV manufacturing facilities in the nation.

The international expansion of China’s automotive industry largely hinges on competitive pricing. Due to the availability of inexpensive cars from China, it is now considerably more common to catch a glimpse of Chinese cars on city streets in Mexico compared to just three years ago. For example, annual sales of Chinese-branded cars in Mexico surged from 28,614 units in 2021 to 129,329 units in 2023. This growth translates to a rise in market share for Chinese brands from 2.8% to 9.5% in those years.

Allegedly, the next strategic move for Chinese car makers involves establishing EV production plants in Mexico. Recent media reports suggest that BYD, the world’s largest seller of EVs, is seeking to expand manufacturing capabilities beyond its home country, with Mexico emerging as a likely location.

Unsurprisingly, concerns are growing in the United States at the prospect of China’s EV firms using Mexico as a launching pad to enter the U.S. market. While the 25% tariff imposed on EVs made in China since 2018 has prevented these firms from gaining access to the U.S. market, existing provisions within the United States-Mexico-Canada Agreement (USMCA) appear to offer a window of opportunity for Chinese EV brands seeking to establish a presence in North America.

Cars manufactured at Chinese-owned factories in Mexico can gain duty-free access to the U.S. market if they comply with local content rules. However, failure to meet these rules subjects the vehicles to a 2.5% tariff when exported to the United States. Understandably, U.S. policymakers and industry groups recognize that the low level of this tariff does little to weaken China’s cost advantage in the automotive sector. To protect the domestic EV and auto industry, additional measures are needed.

A recent bill was presented to Congress proposing a substantial increase in tariffs to 100% on all imported vehicles produced by Chinese brands, including those manufactured in third countries such as Mexico. If enacted, it is unclear whether this tariff spike will prevent China’s car manufacturers from establishing plants in Mexico or entering the U.S. market. However, factors such as the considerable support provided by the Chinese government to its car manufacturers and Mexico’s many advantages — including its free trade agreements with numerous countries, low labor costs, a sophisticated network of auto parts suppliers, proximity to major markets, and the opportunity to diversify its manufacturing base and supply chains from a geographic standpoint — may still incentivize China to pursue either or both of these objectives.

Currently, it is unclear whether Chinese car makers will build manufacturing plants in Mexico or if the U.S. government will impose additional duties on Chinese car imports. However, all signs point to a potential escalation of the U.S.-China trade war, particularly in the realm of EV supply chains. Mexico, which could end up in the middle of this conflict, must tread carefully to avoid jeopardizing its relationship with the United States and its nearshoring opportunities.

Mexico Poised to Benefit but Must Tread Carefully

Considering the significant resources committed through the IRA and Bipartisan Infrastructure Act, along with their associated conditions, the impact of these laws and other legislation extends beyond the United States. As the United States’ foremost trading partner, Mexico must take heed of the opportunities presented by these laws.

Consequently, the question that lingers is whether Mexico will eventually play an active role in the U.S. battery and EV supply chains without allowing China to use it as a backdoor to undermine U.S. strategic goals. At the same time, it will be crucial for Mexico to balance its relationship with China so as not to give up on Chinese investment in the country.

This scenario is clearly challenging, but given the anticipated demand for EVs and batteries in the U.S. — along with the need for the U.S. to de-risk its supply chains and counterbalance China’s rising influence — Mexico increasingly looks like a strategic ally. Under these circumstances, it is reasonable to expect that Mexico will benefit economically from nearshoring, but only if certain conditions are met. Nearshoring, therefore, represents a delicate balancing act for Mexico.

Adrian Duhalt is Nonresident Scholar in Mexico Energy Studies at the Center for the U.S. and Mexico at the Baker Institute and a research scholar at the Center on Global Energy Policy (CGEP) at Columbia University’s School of International and Public Affairs.

This article was originally published by the Center for the U.S. and Mexico at Rice University’s Baker Institute for Public Policy. Republished with permission from the author.