Cleary Gottlieb Advises $904 Mln CBA Sale

Latham, Skadden, Sidley advise closing of FIFCO, Prolec GE deals.

BY LATINVEX STAFF

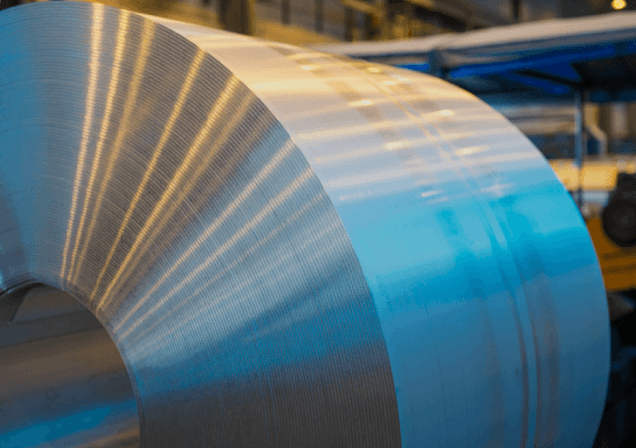

Cleary Gottlieb is representing Brazil-based Votorantim in its sale of a controlling shareholding in Companhia Brasileira de Alumínio (CBA) to Aluminum Corporation of China Limited (Chalco) and Anglo-Australian miner Rio Tinto for 4.69 billion reais (about US$904 million); Sidley Austin and Skadden advised the closing of the $5.275 billion sale of 50% of Mexico-based Prolec GE to US-based GE Vernova (which ranked among the top five deals in Latin America last year, according to Latinvex); Latham & Watkins advised the closing of the $3.2 billion sale of Central American beverage, food and retail company FIFCO to Dutch brewer Heineken in a deal that ranked among the top ten in Latin America last year, according to Latinvex; Davis Polk advised Brazilian digital bank Nubank in obtaining approval for a US banking license and Clifford Chance advised Netherlands-based Rabo Partnerships as the lead investor in a $8.3 million Series B1 financing in Nagro, a Brazilian company focused on transforming agricultural credit for small and medium-sized rural producers in Brazil.

Keywords: Brazil, Cleary Gottlieb, Clifford Chance, Costa Rica, Davis Polk, Latham & Watkins, M&As, Sidley Austin, Skadden